Overhead as a cost claim.

Proving home office overhead. The current issues to watch for in construction claims articles in the march and april 2005 issues of construction update discussed impacts known as cumulative impact cardinal change and abandonment and damage issues related to total cost recovery and proof of delay with scheduling analysis. Home office overhead costs are overhead costs incurred by the contractor that are not associated with a particular project but really are necessary to support the contractor s operations as a whole. Kemmons wilson inc asbca no. Extended jobsite general conditions and home office overhead.

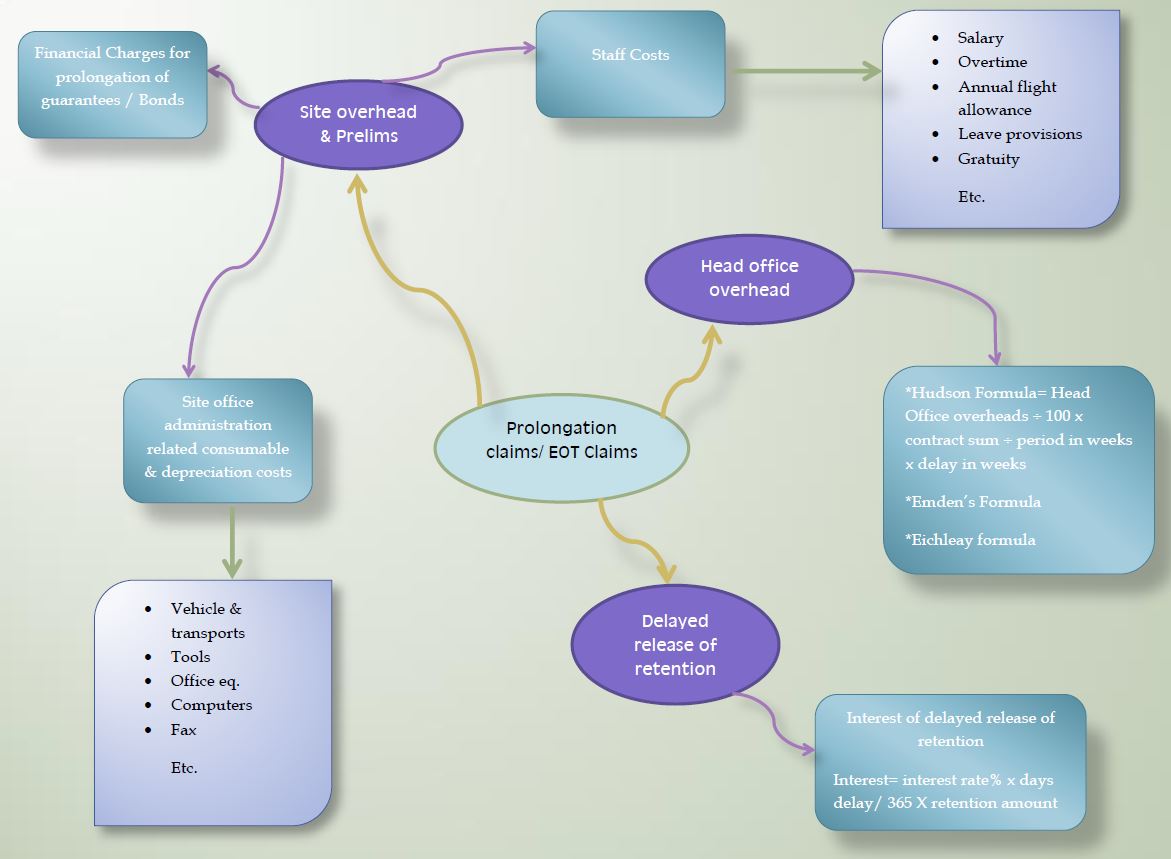

Provided that the contractor has maintained reasonably good cost records during the performance of the work proving the direct delay costs should not be a monumental task. Demonstrating their extended home office overhead likewise is not all that difficult. When construction is delayed by owner caused actions contractors request compensable delay. Or unabsorbed home office overhead costs and extended field office overhead costs.

One particularly difficult area of damages is the. The united states court of federal claims described unabsorbed home office overhead damages and the required elements under the eichleay. Unabsorbed home office overhead is also a well known but not well understood delay damage and like extended field overhead is only caused by a critical project delay. The owner s direct damages generally are those costs incurred in completing or correcting the contractor s work and the cost of delay which is either its actual cost in terms of lost rent or loss of use or liquidated damages.

It may arise from owner directed changes to the work or constructive changes delays in furnishing owner provided equipment or materials suspensions of work differing site conditions slow responses to shop drawing submittals or requests for information or a number of other causes. Home office overhead costs are costs that are incurred to support the work but are not directly chargeable to a specific project. Despite the myriad causes of owner caused delay the. The other kind of overhead is home office overhead.

Owner caused delay is common on construction projects. Job site overhead a well recognized method of proving extended job site overhead is to derive a daily rate by dividing the total job site overhead costs by the total number of days of performance and then multiplying the daily rate by the number of days of delay. It is difficult to reach agreement on causes and extent of delay and even tougher to agree on the cost of delay. Executive director corporate claims management abstract.

Most of those working in the construction contract claims business are familiar with 1960 decision by the armed services board of contract appeals asbca in the eichleay corporation case which recognized a contractor s right to recover unabsorbed home office overhead for owner caused delays and work stoppages. United states 2014 wl 3418445 fed cl. 2014 is a good federal government contracting case discussing a prime contractor s challenging burden to support unabsorbed home office overhead damages caused by a government caused delay. 16167 72 2 bca 9689.

Calculation and recovery of home head office overhead james g. Again the best example of this may be the contractor s home office.